Published in The News Tribune, May 1, 2025

Tariffs won’t revive American manufacturing — and they certainly won’t help the “forgotten half” of young Americans without a college degree, which is exactly where we need to focus if we want to fix what truly ails America’s economy. In justifying tariffs,

Tariffs won’t revive American manufacturing — and they certainly won’t help the “forgotten half” of young Americans without a college degree, which is exactly where we need to focus if we want to fix what truly ails America’s economy. In justifying tariffs,

President Donald Trump claims to be redressing a loss of our nation’s manufacturing base. “Ninety-thousand plants and factories (have been lost) since NAFTA,” he frequently claims, a “fact” repeated by Vice President J.D. Vance, who recently stated that such losses have left small American towns “blighted.”

America does face a real economic problem. But it is not about the loss of manufacturing jobs. Nor is it one that tariffs will fix.

It is true that by some measures, the US manufacturing sector is in decline. Just 25 years ago, over 17 million were employed in this industry; today, fewer than 13 million are. During that same period, however, the inflation-adjusted output of U.S. manufacturing rose more than 40% — from $1.6 trillion to $2.4 trillion.

How could both things be true? It’s because manufacturing jobs are steadily being replaced by machines and technology. With AI on the rise, this trend is only accelerating. Good jobs increasingly require good skills.

But still, could tariffs help to grow manufacturing jobs? Tariffs raise the price of manufactured goods, and higher prices make manufacturing more profitable; they could thereby encourage new investments. Yet past experience with tariffs tells us how costly this approach to job creation is.

One recent study by Goldman Sachs, for instance, estimates that Trump’s tariffs could result in 100,000 new manufacturing jobs; however, the authors also estimate job losses nationwide from higher prices to be around five times this number. Another study of the US steel industry estimated that each new job created by steel tariffs cost steel buyers an additional $650,000, while in the case of tariffs on washing machines, each new job came at the cost of $820,000 more in consumer spending on washing machines.

Tariffs may create jobs in select industries — but they’re an extraordinarily inefficient way to do it.

So what might we do to address our economic ills? The first step is identifying what those problems really are. I’d point to the fact that for decades now, men without a college degree have been increasingly dropping out of the labor force, joining a group that economists call “the discouraged workers.” Falling wages and bleak employment prospects for those without a college degree accounts for a good deal of this trend.

This brings us to our nation’s real economic challenge: not how to bring back yesterday’s jobs, but how to prepare Americans for tomorrow’s. This challenge spotlights a shortcoming in our educational system, one that overly emphasizes a single route from high school to the labor force: college. This is despite the fact that nearly half of all Americans do not complete any sort of college degree.

We do far too little for what the sociologist James Rosenbaum calls this “forgotten half.” Most developed countries’ educational systems offer high-quality vocational options, which a large share of their high school students take. And employment outcomes improve for high school graduates who enroll in high-quality vocational programs compared to those who don’t. Moreover, many countries also provide publicly funded training and skill development opportunities for those over 18.

So rather than looking to tariffs to fix our “blighted” communities, and rather than tearing down our imperfect system of education, what we need from a President is a broader plan to support our youth’s pathway into the labor force.

And yes, that means nudging our educational system toward one that’s more inclusive — by recognizing there’s more than one path to good jobs.

This November, Washingtonians will directly vote on state policy. Alas, the three initiatives on the ballot all address tax policy, and few among us relish the thought of mulling over the details of various tax proposals.

This November, Washingtonians will directly vote on state policy. Alas, the three initiatives on the ballot all address tax policy, and few among us relish the thought of mulling over the details of various tax proposals. University departments –

University departments –  On January 26, the Washington State Supreme Court will hear arguments about whether to uphold the state’s new 7% tax on stock profits larger than $250,000. Foremost, the Court should let the tax stand because it is constitutional. But the tax will also allow Washington’s small towns, especially those that are struggling, to see outsized benefits as it will help fund the new child care services that so many of our state’s rural communities desperately need.

On January 26, the Washington State Supreme Court will hear arguments about whether to uphold the state’s new 7% tax on stock profits larger than $250,000. Foremost, the Court should let the tax stand because it is constitutional. But the tax will also allow Washington’s small towns, especially those that are struggling, to see outsized benefits as it will help fund the new child care services that so many of our state’s rural communities desperately need.

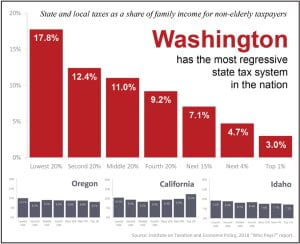

Washington state’s upside-down tax system, the most regressive in the nation, is back in the news. Last year the legislature took an important step toward balancing Washington’s tax code by passing a capital gains tax on the extraordinary profits extremely wealthy people make by trading stocks, bonds, and other lucrative assets. Forty-one states, including the other West Coast states, have a capital gains tax. And while capital gains taxes in general only impact high-income people who buy and sell assets, the tax in Washington is especially narrow and will be paid by only the wealthiest individuals in our state.

Washington state’s upside-down tax system, the most regressive in the nation, is back in the news. Last year the legislature took an important step toward balancing Washington’s tax code by passing a capital gains tax on the extraordinary profits extremely wealthy people make by trading stocks, bonds, and other lucrative assets. Forty-one states, including the other West Coast states, have a capital gains tax. And while capital gains taxes in general only impact high-income people who buy and sell assets, the tax in Washington is especially narrow and will be paid by only the wealthiest individuals in our state. We all know the massive toll that COVID-19 pandemic and its economic fallout have taken on us all. But at long last, we are starting to see hopeful signs of better days ahead – increased vaccinations, restrictions lifted, and plans for kids to return to school. So now – right now – is when Washington state needs to invest in proven strategies that will ensure our state’s long-term health and economic recovery.

We all know the massive toll that COVID-19 pandemic and its economic fallout have taken on us all. But at long last, we are starting to see hopeful signs of better days ahead – increased vaccinations, restrictions lifted, and plans for kids to return to school. So now – right now – is when Washington state needs to invest in proven strategies that will ensure our state’s long-term health and economic recovery. The coronavirus is not just a health disaster, but an economic one as well. There are, of course, the steep declines in income and consumption we are experiencing. But in addition, the economic tumble has translated into reduced state revenue and a gaping budget deficit.

The coronavirus is not just a health disaster, but an economic one as well. There are, of course, the steep declines in income and consumption we are experiencing. But in addition, the economic tumble has translated into reduced state revenue and a gaping budget deficit. Since Covid-19’s arrival, prejudice and fear may be spreading more rapidly than the virus itself. As healthcare workers around the world bravely toil against Covid-19, we must pitch in to combat this disturbing side effect.

Since Covid-19’s arrival, prejudice and fear may be spreading more rapidly than the virus itself. As healthcare workers around the world bravely toil against Covid-19, we must pitch in to combat this disturbing side effect.