Published in the Puget Sound Business Journal July 22, 2024

This November, Washingtonians will directly vote on state policy. Alas, the three initiatives on the ballot all address tax policy, and few among us relish the thought of mulling over the details of various tax proposals.

This November, Washingtonians will directly vote on state policy. Alas, the three initiatives on the ballot all address tax policy, and few among us relish the thought of mulling over the details of various tax proposals.

Typically tax policy is voted on by our representatives in Olympia, after what can feel like endless study sessions, hearings, floor debates and amendments. This is what happened when finally in 2021, the Washington Legislature passed a capital gains tax to support early learning, child care and schools. Initiative-2109 now asks voters to reject this commonsense policy.

In 2023, the state began collecting a 7% tax on the sales of long-term capital assets. Due to extensive exemptions (on real estate transactions, retirement assets, and more), and very sizeable deductions, only a tiny fraction of very rich Washingtonians actually pay this tax. Yet in the tax’s first year, this small number of people collectively provided almost $1 billion in revenue to the state budget — a testament, indeed, to the enormous amount of income very wealthy residents acquire each year from selling stocks and bonds.

On January 26, the Washington State Supreme Court will hear arguments about whether to uphold the state’s new 7% tax on stock profits larger than $250,000. Foremost, the Court should let the tax stand because it is constitutional. But the tax will also allow Washington’s small towns, especially those that are struggling, to see outsized benefits as it will help fund the new child care services that so many of our state’s rural communities desperately need.

On January 26, the Washington State Supreme Court will hear arguments about whether to uphold the state’s new 7% tax on stock profits larger than $250,000. Foremost, the Court should let the tax stand because it is constitutional. But the tax will also allow Washington’s small towns, especially those that are struggling, to see outsized benefits as it will help fund the new child care services that so many of our state’s rural communities desperately need.

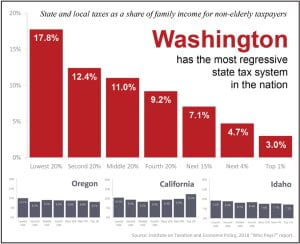

Washington state’s upside-down tax system, the most regressive in the nation, is back in the news. Last year the legislature took an important step toward balancing Washington’s tax code by passing a capital gains tax on the extraordinary profits extremely wealthy people make by trading stocks, bonds, and other lucrative assets. Forty-one states, including the other West Coast states, have a capital gains tax. And while capital gains taxes in general only impact high-income people who buy and sell assets, the tax in Washington is especially narrow and will be paid by only the wealthiest individuals in our state.

Washington state’s upside-down tax system, the most regressive in the nation, is back in the news. Last year the legislature took an important step toward balancing Washington’s tax code by passing a capital gains tax on the extraordinary profits extremely wealthy people make by trading stocks, bonds, and other lucrative assets. Forty-one states, including the other West Coast states, have a capital gains tax. And while capital gains taxes in general only impact high-income people who buy and sell assets, the tax in Washington is especially narrow and will be paid by only the wealthiest individuals in our state. We all know the massive toll that COVID-19 pandemic and its economic fallout have taken on us all. But at long last, we are starting to see hopeful signs of better days ahead – increased vaccinations, restrictions lifted, and plans for kids to return to school. So now – right now – is when Washington state needs to invest in proven strategies that will ensure our state’s long-term health and economic recovery.

We all know the massive toll that COVID-19 pandemic and its economic fallout have taken on us all. But at long last, we are starting to see hopeful signs of better days ahead – increased vaccinations, restrictions lifted, and plans for kids to return to school. So now – right now – is when Washington state needs to invest in proven strategies that will ensure our state’s long-term health and economic recovery. The coronavirus is not just a health disaster, but an economic one as well. There are, of course, the steep declines in income and consumption we are experiencing. But in addition, the economic tumble has translated into reduced state revenue and a gaping budget deficit.

The coronavirus is not just a health disaster, but an economic one as well. There are, of course, the steep declines in income and consumption we are experiencing. But in addition, the economic tumble has translated into reduced state revenue and a gaping budget deficit.