July 20, 2017

Fear Knot, Global Maritime Trade Industry: These SO2 Levels can be Achieved Schooner than you Think

Where did the shirt you’re wearing come from? If you’re like most Americans, it was probably imported after being produced by a factory in Southeast Asia, which accounted for over 70% of clothing imports to the US in 2013. As relatively low-value items, garments are typically transported by container ships across the Pacific before arriving at a West Coast port for distribution in the US. While container ships currently offer the cheapest cost per ton-mile among the different freight transportation modes, that could change under new International Maritime Organization rules that require ships to switch to low-sulfur diesel fuels within the next two and a half years. A recent Bloomberg Markets reports estimates that this new rule could come with a sticker price of $60 billion each year in added fuel costs. The options: retrofitting current refineries to produce low-sulfur diesel, or costly ship retrofits, such as installing scrubbers that remove sulfur emissions from the exhaust. The report further claims that anywhere between 2.5 and 4 million barrels per day of oil could be affected by these new regulations, resulting in a price “three times higher than [the fuel] ships currently burn”.

Checking the Math

Imagine these above estimates are correct. Let’s assume, somewhat conservatively, that 3 million barrels of oil per day are affected, and only the price of fuel is considered in this $60 billion dollar yearly price tag. Through a simple conversion, 46 billion gallons of fuel will be affected each year. If this cost is passed on directly to shipping companies, they will pay an estimated $1.30 more per gallon of fuel. The EIA records historic fuel prices for consumers, seen below for marine fuel, No. 6 (Residual) Fuel Oil.

In recent years, fuel oil’s maximum price per gallon was $2.77 per gallon, recorded during March 2012. The highest yearly average fuel price was $2.46 per gallon in 2012, but dropped to just $0.75 per gallon in 2016. So although fuel oil prices might nearly triple, the resulting prices of around $2.00 per gallon would still be less than they were during much of the last recession. Based on this quick analysis, there appear to be some misleading numbers in this article that could overstate the rule’s potential impacts.

Consider two ships, the container ship COSCO Guangzhou and the crude oil tanker TI Africa, as representative examples of the international maritime trade industry. To determine how these specific ships will be affected by the upcoming regulations, it is important to understand how much energy they consume per ton of cargo per mile. Using energy per ton-mile as a performance metric takes into account the economies of scale that arise as a result of shipping large volumes of cargo across the ocean, despite the higher energy demands of these ships. The Guangzhou is a 9500 TEU (twenty-foot equivalent unit, a standard shipping container size) with 107,000 tons deadweight, capable of a cruising speed of 24.5 knots due to its 52,650 hp Mistubishi diesel engine. The TI Africa has a deadweight tonnage of 441,655 tons, and it is capable of travelling at 16.5 knots due to its 77,463 kW Mecklenburger engine (50,239 hp). These ships both run on marine fuel oil, also known as bunker fuel (heating value: 18,200 BTU/lb, density: 0.95 g/cm3).

An important component of ship fuel requirements is how efficiently a ship’s engine can transform its fuel source into power that moves the ship. This value can be captured through engine efficiency, a ratio between the power used to move the ship a given distance and the input heat required to produce that power. Engine efficiency information was not found for these specific engines, however, a different manufacturer estimates that their marine diesel engines can achieve between 42% and 52% efficiency, so a 50% efficiency for both engines was assumed. This value aligns with the overall efficiency of diesel engines and provides a good starting point for the analysis. The following equation shows how fuel energy consumption can be calculated on a ton-mile basis given ship specifications:

Fuel Energy Consumed per Ton-Mile =

Engine Power / (Deadweight Tonnage * Cruising Speed * Engine Efficiency)

Based on the above equation, the Guangzhou uses 89 BTU/ton-mile and the TI Africa uses 30 BTU/ton-mile. Assuming an average of 60 BTU/ton-mile, this can be used to check the estimate for the barrels of fuel supply affected by the change in fuel regulations. In 2012, global maritime trade resulted in 44.0 trillion ton-miles of shipping. This value further increased in 2015, the last year that data was available, to 53.7 trillion ton-miles of global trade. Multiplying global ton-miles in a year by the energy consumed per ton-mile determines the average daily consumption of barrels of oil.

Fuel Oil Consumption = Fuel Energy Consumed per Ton-Mile * Total Ton-Miles / (Heating Value of Bunker Fuel * Density of Fuel Oil)

After averaging the above estimates for energy consumption, the change in fuel policy would affect 1.2 million barrels of oil per day in 2012 and 1.5 million barrels of oil per day in 2015. Forecasting these values forward to 2020, when the new regulations come into effect, the estimates for the quantity of fuel affected seem a little low, but plausible. If average energy consumption is 80 BTU/ton-mile, then the estimated quantities of fuel affected would seem to be right on target.

Treating the Fuel

Let’s suppose that 3 million barrels of fuel supply per day are affected by this impending rule, and that all of the fuel must be processed by refineries to make it compliant with the new low-sulfur rules. On the refinery side, sulfur is typically removed through hydrotreating. One paper suggests that the cost increase will be more like $13.46 a barrel based off the cost of retrofitting refineries to produce fuel with the necessary standards. Another source based on a process engineering analysis suggests a total cost of at least $180 per metric ton, or $27 per barrel. Extrapolating these numbers out to 3 million barrels per day suggests additional cost of about $15-30 billion per year, well below the $60 billion a year quoted in the article.

Alternatively, each individual vessel could invest in air pollution control device technology, known as “scrubbers,” that remove some particulates and gases from industrial exhaust streams. A basic diagram of one type of scrubber is included below. Scrubbers are installed directly onto ships, costing between $3M and $5M.

The above cited Bloomberg article suggests that there are roughly 100,000 vessels that make up the global trade fleet. If we assume that it costs an average of $4M per vessel, that would cost $400B to retrofit the entire fleet, assuming no vessels already have scrubbers (this is a good assumption considering the Bloomberg article speculates that only 2.2% of vessels with have them by 2020). If this $400B spread out over the three years between when these new levels were announced and when vessels need to be compliant by, is roughly $133B annually; double the $60B suggested in the article. Furthermore, the article also quotes that, “Merchant ships earned an average of about $9,800 a day this year, according to data from Clarkson Research Services Ltd., part of the world’s largest shipbroker. Ten years ago, they were earning about $34,000.” If these numbers are assumed to be gross earnings, not net earning (they don’t include costs), it would have taken 118 days of earnings ten years ago, and 408 days of earning today to pay for a $4M retrofit. Again, those numbers likely don’t include cost so those vessels are probably making significantly less net earnings, which would only prolong the length of time it would take to recoup the capital that it takes to implement an expensive technological upgrade.

The above analysis suggests that unless a more accurate assessment of likely fuel cost increases due to hypothetical refinery retrofitting can be attained, it is difficult to unpack whether the scrubber is more cost effective than increased fuel prices long term for a given vessel. In general, scrubbers will probably be most cost effective for larger vessels, but the exact threshold depends on both the cost of the scrubber and the cost of low-sulfur fuel. This is particularly important since merchants are currently not installing scrubbers, according to the Bloomberg report. While some portion of the merchant fleet will likely install scrubbers by 2020 when the rule comes into effect, most will probably rely on purchasing low-sulfur diesel. If there is not sufficient supply to meet the demand for compliance, the cost of fuel could realistically spike even more than the estimates based on the net price increase from installing hydrotreatment capacity.

How Will This Affect You?

For a second, let’s assume that the new legislation will, in fact, have a $60 billion yearly price tag. Using the previously established average energy consumption per ton-mile and the global ton-miles in both 2012 and 2015, along with the average price of fuel in those respective years, the annual estimated fuel costs for the shipping industry can be estimated. In 2012, during an economic recession and high fuel prices, the shipping companies spent $86.6 billion on fuel costs for their ocean vessels. In 2015, this number was reduced to only $54.0 billion as a result of the global drop in fuel prices. Again, these values were estimated using highly efficient ships with a comparatively low energy consumption per ton-mile in an ideal situation. As such, this estimate should only be considered a baseline for their total fuel cost, and the actual global amount spent on fuel is likely to be much higher. In any case, if the rule cost does incur $60 billion each year in addition fuel expenditures, it could theoretically double the fuel costs paid by consumers, representing a fairly significant increase in fuel costs for a struggling industry.

These higher costs will likely be passed onto consumers in the form of higher shipping and retail prices for similar goods. How much might the consumers pay? That will depend on how much the price of fuel is expected to increase. Using the more realistic price increase calculated by considering the cost to install and operate the additional hydrotreatment capacity to meet the fuel demand ($20 per barrel or $0.48/gallon), typical shipping route distances, and energy consumption rates, the additional cost per TEU or oil barrel can be calculated. For this analysis, only containers loaded to their maximum weight (53,000 lb) are considered to obtain a maximum theoretical price increase. The weight of an oil barrel depends on the temperature, typically ranging between 6 and 8 barrels per ton; 7 barrels per ton was used in this analysis. Table 1, below, summarizes some typical values for different origins, destinations, and commodities.

Table 1: Additional Transportation Costs

| Origin | Destination | Commodity | Additional Cost | Average Cost |

| Shanghai | Seattle | Containers (TEU) | $34 | $1700 |

| Shanghai | New York City | Containers (TEU) | $71 | $1800 |

| Dhuba Bulk Terminal, Saudi Arabia | Shanghai | Oil (barrel) | $0.27 | Not available |

As seen in the above table, while the cost of shipment will increase, it will be a fairly minor increase compared with the amount already paid to ship containers around the world.

Timeline

A significant portion of the column inches in the Bloomberg article are spent criticizing the truncated timeline for initiation of the new rules: “…most refineries won’t invest to convert heavy fuel because that will cost more than $1 billion and take about five years to complete,” “Just 2.2 percent of the fleet will have scrubbers installed by 2020,” and “neither the refining industry nor shipping is doing anywhere near enough for owners to achieve compliance in 2020.” Thus it is important to understand realistic transition periods and the plausibility of the maritime and fuel industries achieving these new goals by 2020. This is especially important given that these newly accepted SO2 levels were only ratified by the Parties to MARPOL Annex VI in October of 2016.

A 2012 study conducted by the International Council on Clean Transportation (ICCT) explored transitions to ultra-low sulfur fuels in four the globe’s largest rapidly developing countries. Their assessment suggests a total transition time for a single refinery of approximately 27-39 months from, “ the country’s official promulgation of a new ULSF regulation, covering one or more ULSF standards until the earliest date at which the full volume of ULSF covered by the regulation conforms to the regulation’s most stringent sulfur standard(s).” So they suggest a baseline time period of 3 years. This is significantly less than the five year assertion quoted above. Further, it is worth noting that per previous analysis, at least one hundred 30,000 barrel/day refineries will need to be retrofitted to meet the 2.5 million to 4 million barrel/day estimated demand. This most certainly could not be facilitated by just the four countries explored in this analysis. Other countries may have much longer, or short, transition periods, based on the diverse factors such as permitting requirements/time, engineering time, equipment procurement time, and construction time.

Are we going to see the benefits?

Clearly the adoption of this new rule provides many challenges for both carriers and refineries, what the Bloomberg markets reports fails to discuss is the benefits of the new regulations on sulfur dioxide emissions. Sulfur Dioxide (SO2) is an inorganic compound that is quite damaging to life in high concentrations. Large sources of anthropogenic SO2 in the atmosphere include: burning of fossil fuels by power plants and other industrial facilities and locomotives/ships/other vehicles/heavy equipment that burn fuel with a high sulfur content, but it does also occur naturally in much lower concentrations. Harmful effects of SO2 include:

- Short-term exposure to SO2 has been shown to be harm the human respiratory system and can cause difficulty breathing. The elderly, children, and those who suffer from asthma are particular susceptibility to effects of SO2.

- SO2 emissions, given the right conditions, can react with other compounds to form particulate matter (PM). PM is another health concern as it has the ability to penetrate sensitive parts of the body, such as the lungs, and cause additional health problems.

- At high concentrations, SOx (SO2 and SO3) can be damaging to flora as well. SOx contibute to acid rain, which is quite harmful to our ecosystems and historic landmarks.

- Finally, SOx can react with other compounds in the atmosphere to form haze in particular geographies and climates around the United States.

Due to all of these harmful effects, it is important to understand how much SO2 exists in the atmosphere anthropogenically (originating from human activity), and how much occurs naturally, to give perspective on how much the global maritime shipping industry emits. Global anthropogenic emissions of SO2 are on the order of 100 Tg, or 100 million metric tonnes. With regard to natural SO2 in the atmosphere, The National Oceanic and Atmospheric Administration (NOAA) suggests that 0.79 Tmol sulfur are emitted annually, which is equivalent to about 50 Tg (50 million tonnes) of SO2.

Assuming 3 million barrels of residual fuel oil per day, with a density of 0.95 kg/l, and that the sulfur content is reduced from 3.5% to 0.5% by weight, then the reduction in global SO2 emissions from this rule would be:

SO2 reduction =

(3 million bbl / day) x (159 liters / bbl) x (0.95 kg/l) x (0.001 tonne/kg) x (3.5% – 0.5% S) x (64 g SO2 / 32 g S) x (365 days/year)

= 10 million tonnes SO2 per year

This is on roughly 10% of anthropogenic sulfur emissions, and 7% of total sulfur emissions.

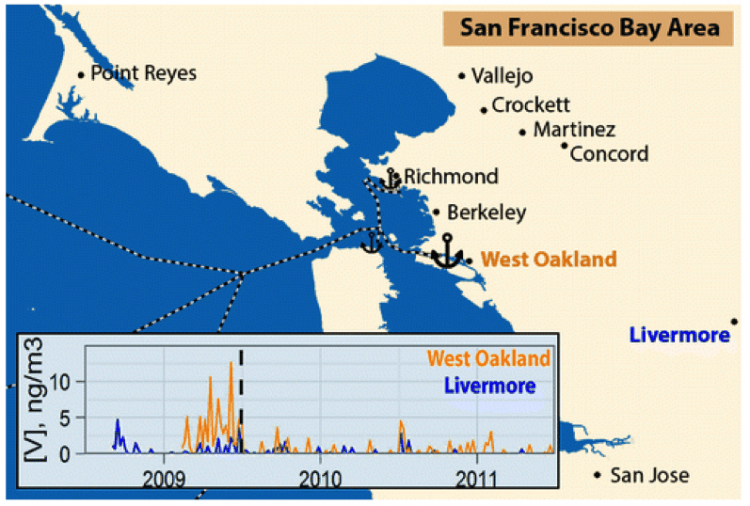

Setting requirements for the sulfur quality of fuel will have clear benefits for reducing emissions although judging the effects of this on both air quality and climate is challenging because of the international nature of the maritime industry. However, when ships come into ports, typically located in dense, urban areas, they bring their air pollution with them, increasing exposure for residents when ships are burning high sulfur diesel fuel. In the San Francisco Bay Area, restrictions on ships at the Port of Oakland saw an improvement in urban air quality. Evaluation of different sites, seen below, in the metro region saw a 28-72% decrease in SO2 concentrations, depending on proximity to shipping lanes, and a 3% decline in PM2.5 concentrations. This study indicates that urban port areas’ air quality would improve as a result of switching to low sulfur fuel. It is also worth noting that in many port cities, particularly in the United States, the neighborhoods directly adjacent to the Ports are generally lower income, minority neighborhoods. So this is also an equity issue.

Would switching to low sulfur diesel also provide the magical cure for global warming, allowing the world to meet climate change targets set in Paris? Unfortunately, no. Sulfur dioxide as a greenhouse gas transforms in the atmosphere to an aerosol which has a complicated relationship with global temperature. Aerosols scatter more light and increase cloud cover which could reduce the potential for global warming, although there are also significant regional differences between their effects. As such, it can reasonably anticipated that sulfur dioxide emissions can serve to cool global temperatures. Realistically, this could mean that global temperatures could increase more rapidly if anthropogenic emissions of sulfur dioxide are significantly decreased as a result of this rule. However, the climate science surrounding sulfur dioxide emissions are far from certain, so it should not be used to justify lack of progress, particularly when there are clear air quality benefits from reducing emissions.

Conclusions

The assertion that these new International Maritime Organization rules, “…will be an absolute chaos,” is a bit much, perhaps reflecting the broader melodrama that is modern day journalism. Some of the numbers in the original Bloomberg article, particularly the quantity of oil affected, seem realistic. Other values, like the cost of the rule on fuel price, seem to be inflated, particularly because these costs can be recovered by passing at least some of the costs through to consumers. The timeline for implementation is more accurate. While realistically, refinery capacity could be expanded within three years, this is still past the date by which the rule goes into effect. Furthermore, there is currently not even planning for meeting the rule’s goals which could extend the timeline further.

Ultimately, this issue of non-movement and doubt about attainability seems to stem from the fact that the reductions could potentially be achieved from retrofits to two different systems (refineries, and/or vessels). Each is part of an industry that is very independent of the other. Both is likely waiting for the other to act, and in the meantime, the timeline is becoming less and less feasible. Further, as this paper has shown, the vast ranges of numbers based on assumptions make it extremely difficult to speak with much certainty about the likely effects that these new SO2 rules will have on trade.

This also likely explains how the authors of the Bloomberg article, cited above, came up with the $60 Billion dollar per year price tag. For all retrofitting to be done on the vessel side, it would cost roughly $133B annually (though only for the 3 years between 2017 and 2020), and for all retrofitting to be done on the refinery side, it would cost something like $15-30B annually (on an ongoing basis). As these retrofits will likely happen in some proportion on both sides, a $60B annual price tag may make some sense…at least for the few years leading up to 2020. It is, however, very misleading to imply that that number has enough practical significance, when compared to current expenditures by the global maritime trade industry on fuel, that it would make much of a difference for them to pass that bill on to the consumer.

In light of the challenges in implementing the rule, cleaning up the fuel used in the marine shipping industry can provide a meaningful reduction of about 10% in total annual anthropogenic emissions of sulfur dioxide. This reduction can be translated into clear health benefits for the globe, and more specifically, for communities living near a port, which can justify this regulation’s cost.

Recent Comments