July 8, 2022

Are high interest rates undercutting the case for EVs?

Don MacKenzie

At first glance, high gas prices should be driving increased demand for EVs. The basic intuition is: EVs cost more up front, but save you fuel expenses over time; the larger the spread between the cost of driving with gas and the cost of driving with electricity, the more attractive EVs become. But as Liam Denning points out in a column for Bloomberg, gas prices aren’t the only thing rising these days: interest rates have been going up too, and higher interest rates mean higher monthly payments for the same purchase price. In fact, Denning uses some simple calculations to estimate that 40% of the increase in the combined cost of loan + fuel payments is due to increases in interest rates, for a typical new vehicle. And Denning also notes that since EVs cost more than their gasoline fueled counterparts, they will be hit harder by this increase in interest rates. However, he stops short of fully exploring the net effect of rising gas prices and rising interest rates on the attractiveness of an EV. That’s the topic of this post.

Building on Denning’s approach, I’m going to consider the combined monthly cost (loan payment + fueling) of an electric F-150 Lightning pickup compared with a gasoline F-150. I use a few basic assumptions throughout: a 20% down payment, 72 month loan term, 1000 miles of driving per month, and the mid-range Lariat trim level. I assume the US average residential electricity price of $0.137/kWh. I assume the conventional F-150 gets 21 miles per gallon and the Lightning uses 50 kWh/100 miles. I use a list price of $48,450 for the conventional F-150 Lariat and $67,474 for the F-150 Lightning Lariat. For the EV, I assume the purchase price is the list price minus a $7500 federal tax credit.

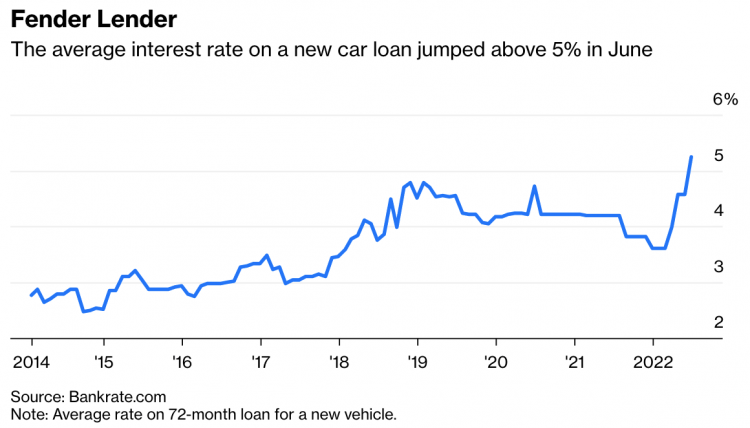

Denning provides the following chart of average car loan rates:

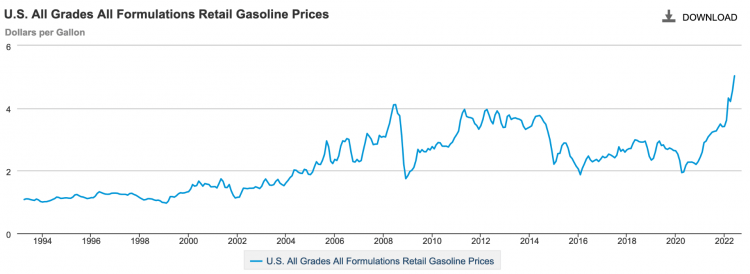

And we can look at historic gas prices from the Energy Information Administration:

In a case in which gasoline is $3.00/gallon and car loans can be had at 3%, the electric option would lead to a combined monthly expenditure $66 higher than the conventional.

| Conventional | Electric | |

| Monthly Payment | $589 | $729 |

| Monthly Gasoline Cost | $143 | $0 |

| Monthly Electricity Cost | $0 | $69 |

| Monthly Payment + Fueling | $732 | $798 |

Now consider a case in which gasoline is $5.00 per gallon and the loan rate is 5%:

| Conventional | Electric | |

| Monthly Payment | $624 | $773 |

| Monthly Gasoline Cost | $238 | $0 |

| Monthly Electricity Cost | $0 | $69 |

| Monthly Payment + Fueling | $862 | $842 |

Comparing the two cases above, we can see that the higher interest rate does, naturally, hit the EV harder: it increases the EV loan payment by $44 / month, versus $35 / month for the conventional truck. But the rise in gas prices still swamp this effect: at $3.00 / gallon the EV costs $74 less to fuel each month than the conventional vehicle, but at $5.00 / gallon this surges to a savings of $169 / month. And overall, the EV comes out ahead by $20 / month.

There’s a lot more to this, of course. Electricity prices vary a lot across the country – much more than gasoline prices do. And not all charging happens at home on residential rates. And I haven’t really considered the difference in down payments, which would also be higher for the EV. If you want to try changing some of my assumptions, you can get a copy of the simple spreadsheet that I set up.

Recent Comments